Are you tired of living paycheck to paycheck? Do you want to take control of your finances and reduce financial stress in your life? If so, mastering your finances through effective budgeting is the key to achieving financial stability and peace of mind. In this article, we will explore essential budgeting tips to help you take control of your money and build a brighter financial future.

The Importance of Budgeting

Budgeting is a crucial tool for managing your finances effectively. By creating a budget, you can track your income, expenses, and savings goals, allowing you to make informed financial decisions. A well-thought-out budget can help you identify unnecessary spending, prioritize your financial goals, and avoid debt. Ultimately, budgeting gives you a clear picture of your financial situation and empowers you to take control of your money.

Setting Financial Goals

Before you can create a budget, you need to set clear financial goals. Do you want to save for a vacation, pay off debt, or build an emergency fund? By establishing your financial goals, you can tailor your budget to prioritize these objectives. Ensure your goals are specific, measurable, attainable, relevant, and time-bound (SMART) to keep you focused and motivated.

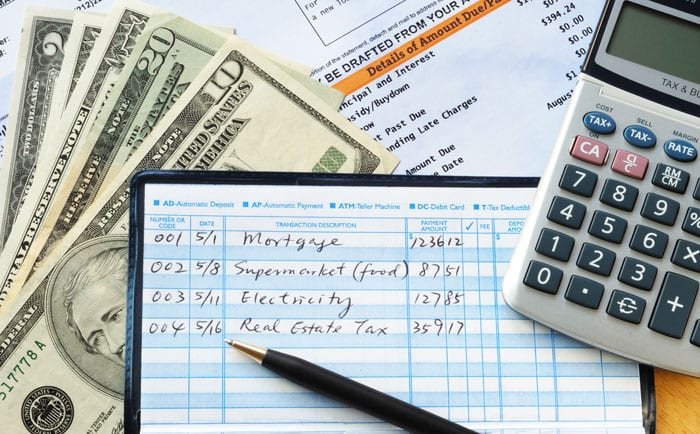

Track Your Income and Expenses

To create an effective budget, you need to know how much money you are bringing in and where it is going. Start by tracking your income, including your salary, bonuses, and any additional sources of revenue. Next, track your expenses by categorizing your spending into essentials (such as rent, utilities, and groceries) and non-essentials (such as dining out, entertainment, and shopping). Understanding your cash flow is essential for making informed financial decisions.

Create a Budget

Once you have a clear picture of your income and expenses, it’s time to create a budget. Allocate your income to cover your essential expenses first, such as housing, utilities, and transportation. Then, allocate a portion of your income towards savings goals, such as an emergency fund or retirement account. Finally, allocate a portion of your income to discretionary spending for non-essential items. Be sure to adjust your budget as needed to align with your financial goals.

Monitor and Adjust

Budgeting is an ongoing process that requires regular monitoring and adjustments. Track your spending regularly to ensure you are staying within your budgeted limits. If you find yourself overspending in certain areas, identify areas where you can cut back to stay on track. Be flexible and willing to make changes to your budget as your financial goals evolve.

Conclusion

By mastering your finances through effective budgeting, you can take control of your money, reduce financial stress, and build a solid financial foundation for the future. Remember to set clear financial goals, track your income and expenses, create a budget that aligns with your objectives, and regularly monitor and adjust your spending. With these essential budgeting tips, you can achieve financial stability and enjoy a stress-free life.

Now that you have learned essential budgeting tips, are you ready to take control of your finances and build a brighter financial future? By implementing these strategies, you can reduce financial stress, achieve your financial goals, and enjoy a stress-free life. Remember, budgeting is the key to mastering your finances and securing a stable financial future.

Find it Interesting? You Can Also Read Articles on Career Advice By Clicking Here